What is actually CFD Change As well as how Can it Work?

But really so it isn’t constantly the situation, on the fundamental exemption getting an onward bargain. An onward deal provides a keen expiry date in the a future date and has all right away financing fees already within the spread. Register eToro and now have use of exclusive eToro Academy posts such as since the on the internet programmes, inspirational webinars, monetary courses and you will month-to-month knowledge to the email.

Advantages and disadvantages from CFDs

A button element of CFD exchange try searching for how many agreements you need to exchange. Purchase rates are nevertheless higher than the brand new tool’s current underlying value. Inside CFD trading, you trade Much time is when you imagine rates is certainly going up. When you yourself have felt like and therefore business you want to trade, you are prepared to start change. Basically, the brand new control ratio find the amount of margin you ought to features on the membership.

CFD Exchange against. Old-fashioned Trade

When a trader’s membership sustains straight loss, an excellent margin label alerts might possibly be sent, and this claims one to additional financing need to be placed into its membership. The new agent you will instantly romantic all their unlock positions when it is not fixed. Traders and you may people you may make use of hedging into their strategy to counterbalance potential loss within present profiles. Hedging works by starting the right position reverse for the one in an investor’s portfolio. As mentioned ahead of, traders have the option to open up both much time (buy) and you will quick (sell) positions. The benefit here is a lot more it is able to discover small (sell) positions since the even when you’ll be able to, it’s tough to short deals in the traditional investing.

Great things about CFD Trading

To train just how CFD change performs used, why don’t we realize a step-by-action exemplory case of a https://onpromedia.com.br/5-common-paying-procedures-having-fun-with-binary-alternatives/ swap. Such, if you purchase a great CFD at the selling price out of $ten.05, plus the bid pricing is $10.00, the brand new asset have to appreciate because of the at the least $0.05 just to break even. Because the SEC provides limited the new trading out of CFDs regarding the U.S., nonresidents is change him or her.

Because the AI adoption expands, the risk of herd-such as behavior in addition to develops—in which a lot of investors stick to the exact same signals rather than knowing the underlying vehicle operators. To help curb your possible losses, you could love to add a halt. Closes instantly romantic your situation if field moves against your by the a selected count. You could lose money in case your field moves against you and you are clearly not using sufficient exposure administration equipment.

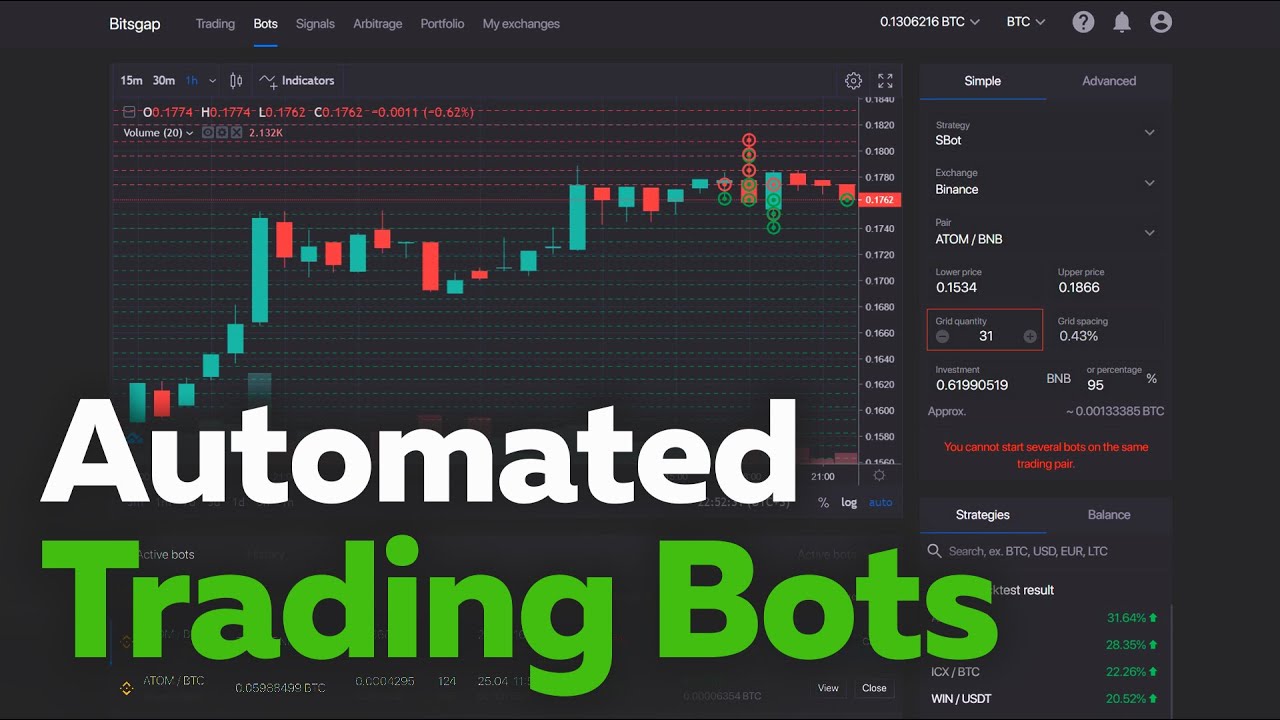

In the change, the fresh buyer is also screen price actions with the broker’s change program. They could fool around with systems including prevent-loss and take-funds orders to handle exposure and safer earnings instantly. Leverage is actually unit otherwise element away from CFD trading which allows buyers to handle a bigger position in the industry having a smaller amount of funding.

We’re also going to direct you simple tips to knowledge trading one another long-and-short CFDs instead risking any real cash. If you would like end up being a experienced, confident buyer, read on. Leveraged trade was at times known as ‘trading to the margin’ as the margin – the fresh finances expected to open and sustain a posture – stands for only a portion of the full proportions. Not having the underlying resource can be enable traders to apply certain fascinating capability has. When you may use end loss with quite a few CFD business, that won’t shield you from all of the negative speed moves. The ability to wade long or small brings investors which have a great varied band of actions.

You could potentially generate losses inside sterling even when the inventory rates goes up on the money from supply. Carries noted on overseas exchanges could be subject to additional dealing and you may exchange rate charge, and may also features other income tax effects, that will maybe not supply the exact same, otherwise people, regulatory security as in the united kingdom. CFDs, the forex market and you can pass on gambling are highly speculative points, and therefore on the vast majority out of merchandising people comes to a top chance of dropping some otherwise almost all their currency. As opposed to to shop for individual shares due to traditional form, the brand new trader chooses to enter a lengthy CFD package with an online CFD merchant simply because they predict an appearing business inside AAPL’s stock rates. The fresh give to your quote and have rates will likely be high in case your hidden asset knowledge significant volatility otherwise speed motion. Investing a huge bequeath to the entries and you may exits suppresses profiting from brief actions in the CFDs, decreasing the level of winning positions and you will expanding losings.

Whenever getting into a great CFD, a trader and you can representative commit to exchange the essential difference between the fresh starting and you can closing value of the root financial equipment. Going enough time form to purchase a good CFD with the hope that the cost of the root advantage often rise. In case your field moves in the expected advice, the brand new individual can make a return. This is basically the old-fashioned technique for trading whenever people trust a keen asset’s worth increases over the years. Extremely people like to play with stop-losings and you will limitation requests smartly to guard their CFD positions and you can maximize its trade production. Whether or not going enough time or going quick CFDs, a stop-loss acquisition often automatically terminate a burning condition if the business is at a designated threshold value, thereby limiting your possible losings to a tolerable peak.

Simple tips to Trade CFDs

A related and well-known error are bouncing to your expert programs also soon. The brand new disadvantage is the fact such as leverage may cause high losings due to extreme speed volatility. And also the restricted controls of the CFD field form You.S. people don’t change her or him. CFDs offer traders with all the benefits and you will risks of possessing a safety as opposed to indeed owning they otherwise having to take one bodily beginning of your own investment. People that comprehend the opposite down direction will sell a hole position.

Below average if you don’t downright fraudulent online agents can also be victimize naive subjects. CFD traders thus must diligently ensure an online agent’s regulating history and check out the character which have existing customers just before beginning an investments membership. Because of this, you could just go back to one to same broker to close out the new CFD package. Wider quote-inquire advances will often emerge in the a broker while in the quick segments that can impede while increasing the purchase price doing work in the CFD trade records and you may exits. While the CFDs can be more very leveraged than just positions from the fundamental assets, even modest action within the underlying advantage cost may cause disproportionately high CFD status valuation shifts. When they anticipate an impending stock market refuse considering broader economic suspicion, they may get into face-to-face short CFD ranks facing its existing technology stock ranking as the a hedging approach.

This type of might not be highest but nonetheless need to be factored to your method planning. Actually, these charge are among the explanations why you to CFDs are primarily useful for brief-identity exchange. When the committing to CFDs more than a longer period of time, the brand new costs obtain you’ll negate any possible earnings otherwise worsen one loss.