No deposit alternatives: the fresh trend you cant forget about

Despite this, the majority of people fool around with PayPal to transmit currency, therefore it is a handy option for money transmits outside of regular bank account. Most of the time, these fees try $15 and they are recharged once per month up until a purchase is actually made. Keep in mind that certain banking companies and credit unions acquired’t fees inactivity costs, otherwise simply fees him or her should your balance is less than a specific amount. Meanwhile, of many banks tend to costs people for making a checking account totally inactive. For individuals who wear’t done any deals together with your bank account for a long time—generally one year—the lender can charge your laziness charge. Therefore, you will find usually a threshold out of six totally free withdrawals open to your in this confirmed report several months.

Misc Features

Among the financial institutions one to deal with undocumented immigrants tend to be Wells Fargo, PNC, U.S. Lender, BMO Harris, Alliant Borrowing from the bank Partnership, Lender from The usa, HSCB, and you may TD Bank. This will make sure he’s well-prepared to changeover to help you a new nation and take off the pressure of taking care of cash within the an already stressful procedure for moving to another nation. You Bank accounts to have Overseas Nationals will likely be a good way to cope with your All of us spending while you are overseas.

Say goodbye to security dumps.

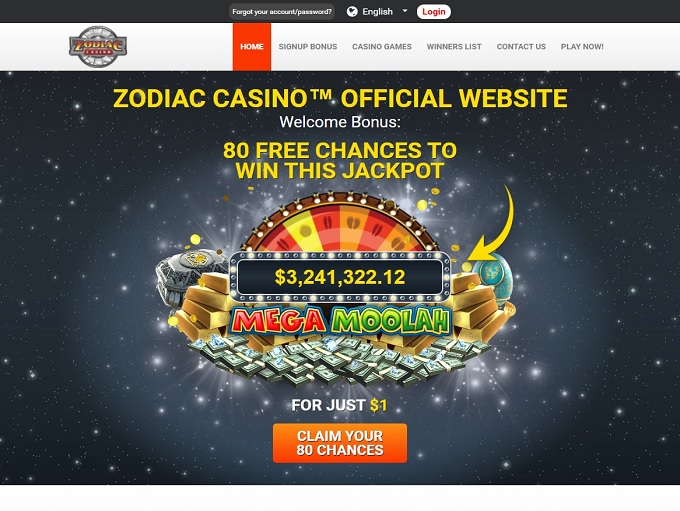

A no deposit incentive ‘s the most effective way so you can kickstart your internet casino feel. Score a chance to earn real cash without the need to put an individual cent! No-deposit incentives are ideal for trying out the fresh gambling enterprises instead one monetary partnership. Keep in mind that PayPal’s costs can sometimes be highest, and their rate of exchange are often more than those people utilized by competitors. The big disadvantage to correspondent financial would be the fact it’s both slow and you can expensive. Rather than home-based instantaneous currency transmits, the brand new Swift system needs time to work due to the connectivity possibly needed to arrive a different bank.

Annual Payment Produce (APY) try direct as of XX/XX/XXXX, try subject to transform with no warning, and will be calculated and fixed to the name at the investment. It’s an insurance policy where the citizen will pay a low- vogueplay.com More Info refundable fee every month (otherwise premium), for as long as the fresh citizen have a rental. The brand new monthly fee is dependant on the new citizen’s credit history which can be paid back straight to Rhino. Inside the software processes, you will observe a good checkbox on the Put Waiver alternative.

Although not, be mindful one to change sells risks, and you will eliminate the complete money. Normally, you’ll want to establish who you really are, get your bag create, and regularly you’ll need to engage in specific first trade or fund your bank account which have the very least deposit. According to the exchange’s formula, you may want to verify your account. It verification techniques usually concerns getting identity data files to be sure shelter and you can conformity with legislation.

Starting a bank checking account on the internet is constantly limited to owners merely, if you don’t’re using a global otherwise correspondent account (see below). The new Axos Bank Benefits Family savings offers an absolute combination of provides. And also the lender brings endless reimbursements to own home-based out-of-network Automatic teller machine charge. All the services to your Tradersunion.com web site is free to work with.

To join PenFed, you ought to open a savings account and you can deposit no less than $5. You could potentially’t access the new family savings rather than an excellent PenFed bank account. Our deposit alternative solution makes you lessen forgotten rent and you will problems, promote all the way down circulate-within the alternatives and relieve bad personal debt as opposed to dropping apartments away from high protection places. This is why you will want to simply dedicate currency that you will be prepared — otherwise can afford — to lose during the such high dangers. Tradersunion.com cannot offer one financial features, as well as money otherwise economic consultative functions.

New registered users can be allege a pleasant present package value up to 6,2 hundred USDT by signing up, and make the basic put, and completing deals in this 7 days. As well, for every friend known, users can also be earn a supplementary two hundred USDT inside benefits. Each day take a look at-in and activity completion give after that opportunities to gather items, and that is used for exchange bonuses and USDT. Having each day and a lot of time-name bonuses, Bitget have pages engaged and rewards energetic contribution on the system. The newest HTX Interests Cardio also offers various advantages both for the new and you will present profiles. Participants is also unlock individuals advantages by doing jobs for example finalizing right up, to make its basic put, otherwise change.

You’ll gain access to Zelle to send and you may receive money, on the internet and mobile financial, and online costs spend provides as well. RFC Fixed Deposit gets NRIs who have gone back to Asia an excellent a chance to secure higher output to your money they hold within the foreign exchange. Even if you can be’t discover a All of us bank account, or if you need take control of your currency as you wait to open up you to definitely, you can still find solutions for your requirements. If you are an overseas account is a great alternative to an everyday United states checking account, they indeed aren’t for everyone.

The common rate of interest to possess an interest-making checking account is 0.07% inside December 2024, with regards to the Federal Deposit Insurance Business (FDIC). Probably the most popular were month-to-month restoration charges, lowest equilibrium fees, overdraft costs and you will Atm costs. A $15 monthly repair commission, as an example, manage ask you for $180 annually. It membership combines each other examining and you will savings has, thus dependent on your financial requirements, it may meet your needs.

Lose security dangers

Consider using an online individual system (VPN) for added shelter when performing online banking transactions outside your residence network. Keeping a low-citizen bank account means patient management and a hands-on way of shelter. Effective management decreases potential items and you will assurances smooth usage of their financing.

Any person or entity may have FDIC insurance policies in the a keen insured lender. Men need not getting a U.S. citizen or citizen to own their places covered by the newest FDIC. For individuals who’re also residing in the united states but i have yet , for resident position, you can make an application for a checking account in person. On line functions usually are restricted to Americans and long lasting citizens merely. As the beginning a timeless family savings will likely be difficult to possess non-owners, you could potentially turn to other choices, for example an excellent multi-currency membership, a major international account, and you will an excellent correspondent account.

It’s as well as ideal for people that don’t overdraft the profile usually. Axos also offers twenty-four/7 customer care through cell phone and you will safe online messaging. Your website also offers a real time chat element offered during the regular business hours. For the most careful, numerous courses and you can guides give a danger-totally free way to acquire crypto exchange training.