Listing of prominent lender downfalls in the united states Wikipedia

Posts

The beautiful failure of two American financial institutions and also the loss of individual trust inside Borrowing Suisse triggered nuts industry shifts and you can place Wall surface Street on the boundary. The brand new closing of them branches will likely be for example difficult for old consumers, who’s a lot more problems with on the internet and cellular financial features. Yep as the home loan on your own household, the financial institution is also phone call one to in the each time needed too and kick your out on the trail if you fail to spend they. There is nothing a hundredpercent secure, actually “Insurance” fails in case your issue is just to high, the insurance coverage organizations falter. The complete program existence for the line, really would not take that much to finish with an angry Max knowledge.

Estimate their Video game earnings

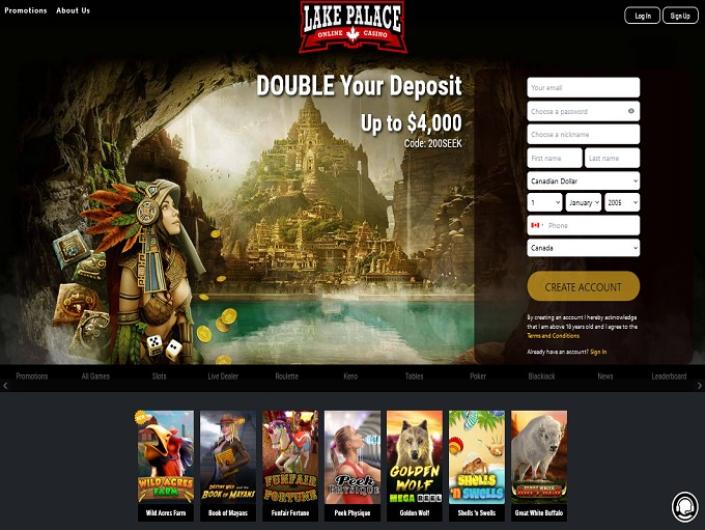

We ask our clients to evaluate your local gambling laws to make sure gaming is actually courtroom in your jurisdiction. We cannot be held responsible to the interest out of third-party other sites, and don’t remind betting in which it’s unlawful. The brand new bank’s user banking operation really stands while the a particularly brilliant location, boasting 23 consecutive home from online the new savings account gains. Meanwhile, its money management department provides capitalized for the robust request, as the international segments section provides achieved list equities conversion and you may exchange volumes. Causing so it impetus, Bank away from The united states successfully rode the new revolution of curing merger and you can purchase activity, which have higher consultative costs bolstering their around the world banking funds. Specific commentators recommend moving your money out of the banking system entirely – for the bucks, cryptocurrencies or precious metals.

of the finest Ports to experience which have step one

Within just two-and-a-half ages, the brand new U.S. provides seen of numerous monetary panics having lead happy-gambler.com additional reading to works for the banking companies and you can bank collapses. While the failures out of Signature and you will Silicon Valley Banking companies continue to be fresh within thoughts, it’s a good idea first off at first. To have a fairly younger nation, the usa features an amazingly much time history of monetary chaos. Regarding the Panic away from 1819 to your latest pandemic, several major events have resulted in drastic reductions in the production, high unemployment, and you can unrest on the financial business. Simply days through to the one-seasons mark out of Silicone polymer Area Bank’s collapse, Nyc Neighborhood Bancorp averted an identical destiny, thanks to a good step one billion dollars infusion led because of the previous Treasury Secretary Steve Mnuchin. Grassley and you will Whitehouse have per produced regulations they claim is key to help you closure loopholes inside the United states rules which might be earnestly rooked by the newest cartels’ currency launderers.

Simply banking institutions and you may borrowing unions which have broadly readily available Video game offerings made record. When deciding on where to have fun with the on the internet position game “Breasts The bank ” it’s important to consider the RTP (come back to player) grounds. Gambling enterprises feel the independence setting the new RTP to have “Boobs The lending company” centered on its tastes so it’s better to read the casinos RTP just before to play.

- The multimillionaire is at the lower stop of being singlehandedly in a position to improve their banks’ money/loss statements by his decisions, thereby his financial often struggle to store his business.

- By-the-method, the fresh features of to play for real currency and you can to play 100percent free are no additional.

- This type of banks had been smaller compared to the others to own hit a brick wall inside 2023 and you may gotten shorter news desire.

- Exactly like Chime, customers of one’s neobank Newest can also be deposit dollars during the individuals places in the country, and playing 7-Eleven, CVS, Dollars General and Members of the family Buck urban centers.

- However, a little couple of banking institutions are heavily dependent on the brand new charges to exist.

People can access 43,one hundred thousand within the-system ATMs, and you may Ally doesn’t costs consumers for making use of out-of-circle ATMs. Furthermore, they reimburses around ten each month within the Atm surcharges imposed from the other banks. All signed up and you can controlled online casino functioning in the united states needs the very least deposit before you start out with actual-currency playing. Minimal required count will vary and change in accordance with the vendor you select.

- It might have taken the usa 90 decades and you may counting in the united states to achieve the program that people provides now.

- Pala Local casino does not require a minimum deposit for individuals who create fund via the Dollars-at-Crate alternative.

- Finding the ultimate rewards program to own an online casino is actually problematic because utilizes the new online game the gambling models as well as your gaming amounts.

- The newest problems out of about three highest You.S. local financial institutions at the beginning of 2023 taken to happen a risk on the that FDIC got alarmed for a long time.

- Financial institutions over the years provides based their retail bona fides for the probity and you will trust.

That’s because uninsured deposits are held because of the apparently couple depositors inside the huge amounts. Also and if hypothetically that you can to-break profit various other bank accounts to get full coverage and all sorts of the profile come in best positions creditors in the Us, you simply can’t believe in FDIC when the all or the majority of those individuals financial institutions wade bankrupt. Because the FDIC merely provides an excellent meagre 25 billion dollars to pay for the bank account in america. And you be aware of the amount of financial places inside the Us work with inside the at least a trillion away from bucks. Whenever anyone with a web worth regarding the a huge selection of millions makes a phone call or private stop by at the fresh financial associations addressing their money, there’s a lot of cash on the fresh range in making yes see your face are well looked-just after.

Playing Pub Casino and you will Lucky Nugget Local casino forty five Totally free spins added bonus

The issue with this would be the fact 100k is not enough for these with the most to loose. When you have a lot of otherwise reduced like any somebody, yeah the bad however, hardly the conclusion the world. Even 250k is still lack of however, best, at the very least you have smaller problems spreading one to from the some other financial institutions, even if you has a million. Savers might possibly be investing in it which have all the way down production on their TD’s for sure. If the a subscribed financial (that is all the put ensure relates to) try doing something you to blatant and implementing a life threatening fee things uplift (that incredibly unrealistic) to your race, next i’ve larger endemic items inside play. Depositors are at the bottom of the safety dinner-strings, about even Level step 3 lenders otherwise investors, the latter just who you are going to no less than release a class step fit according to tortious negligence in the event the the chosen funding went stomach-upwards.

Just what United states for the-range casino provides you with a free extra which have 5 lowest set?

Customers from on the internet-only bank LendingClub is also put dollars to their membership any kind of time NYCE Shared Deposit ATMs and you can MoneyPass Put Getting ATMs. Consumers away from Axos Financial is also deposit cash in the using Automatic teller machine towns regarding the nation. The lending company along with people to your Environmentally friendly Dot Circle to allow people to put dollars into their accounts during the certain stores all over the country, such as 7-11, CVS, Dollar Standard, Walgreens, Walmart, Kroger, Rite Support, Safeway and you will Expert Dollars Express. Pros which earn info, for example bartenders, host and hair stylists, could possibly get frequently have to deposit cash. Of numerous entrepreneurs who’re paid-in cash along with commonly you desire to put they regarding the financial.

Such as, the new FDIC cannot develop the fresh fund throughout the memories nor renew they to guard taxpayers. 2nd, the rate you to banks paid off didn’t are different from the chance and you may high-risk banking companies had been charged only about secure of those. It was seen as both unfair and you will performing bonuses for excessive risk-delivering. The balance one to European countries went on to work to attain was to allow it to be banking companies to perform freely across inner boundaries and make clear the new standards for the organised management of the fresh incapacity of these cross-edging banking companies. One directive centered the chief your home power might be accountable for protecting insured depositors of an unsuccessful banking team.

For those who care for the typical everyday equilibrium of 5,000 or higher and make at least 20 debit card purchases 30 days, you could potentially earn perks. Filtering Lender allows the newest Complete Checking consumers to make as much as 2,five-hundred inside a funds extra after they manage the absolute minimum mediocre harmony for a few months. It buy encourages financial integrity from the helping the newest Department of your own Treasury so you can quicker conduct incorrect fee and you may con avoidance tests before disbursing funds on account out of organizations. So it purchase grows visibility and you will accountability because of the demanding businesses to incorporate the brand new Department of one’s Treasury with the information necessary to track transactions from General Financing inside more detail. So it acquisition in addition to promotes working performance because of the returning disbursing services in order to the newest Service of one’s Treasury whenever possible and you will consolidating and you will standardizing center Government monetary options.