Where you should Get Chicago Financing Characteristics in the 2022?

Posts

For the closer inspection, the newest disperse isn’t because the bizarre as it appears. Just in case the individuals answers aren’t satisfying, the new council’s answer should not be any. Simply remember that having high rates, you could find it hard so you can income, despite these types of criteria. CHICAGO (WLS) — After two years from evident declines, the newest Federal Connection out of Real estate agents anticipates transformation from established home have a tendency to raise within the 2024. I looked into hard money’s preparations and shown him or her what i are seeking create and just like that they managed to get it is possible to.

The new Property Locations Where Request try Warming up Larger-Go out

Without the element earnest currency, a real home buyer could make offers to your of many home, basically taking her or him from the business up until it felt like which they liked greatest. Providers rarely accept also provides without any customers placing down serious money showing that they’re really serious and therefore are making the render within the good faith. Earnest money is generally a trust percentage which shows the brand new merchant that you will be serious about to shop for their house. Very for example for those who pay 5percent inside serious currency (abbreviated as the EM) and your full downpayment is actually 20percent then that means you have already paid back 5percent of your own downpayment beforehand. Very during the closing you would pay only the remaining 15percent of one’s deposit as well as your closing costs. Dan Nelson, an investor-friendly agent within the Chicago, claims he loves “buy-and-keep local rental features for this town.

The brand new Illinois An excellent Finance laws find what for the cash to possess closure have to be inside. Generally, the brand new closing disclosure taken to the consumer by lender about three months prior to closing might possibly be a decent guess (but usually perhaps not the last matter) out of financing needed to intimate. The real amount required can be gotten by the a home closing attorneys and you will communicated for the Client on the day before closing on the term business. In case your finance must intimate have excess of 50,one hundred thousand, up coming that cash must be wired. If the fund try under fifty,000, up coming an excellent cashier’s or formal consider is necessary.

All of our Chicago Area 1

You can buy investment characteristics within the Chicago’s Western Town people. West Area has several things within the choose to possess Chicago genuine estate investment. The newest colleges is mediocre to own Chicago, however, offense and you can defense is actually a bit a lot better than mediocre.

- He’s along with the servers of the best-rated podcast – Couch potato A home Paying.

- Becoming rehabbers our selves, that is an enormous benefit to the consumers as we know just what demands of numerous borrowers run into whenever dealing with loan providers and you may we try to ensure those people try avoided at all costs.

- Zero, at the Insula Financing Category, we prioritize visibility and you can easy terms.

- We have been a leading across the country individual bank and investment company.

How does It Make a difference inside a-sale?

A large amount of leasing functions have been forgotten to construct single-family house or condos, and no you’re strengthening certainly not higher-avoid apartments now, to make pick-and-keep apartments most worthwhile. Because the fewer and you will fewer leases become available, rent continues to rise. The tough Money Co. is actually established in Milwaukee possesses given numerous financing for the winning investment historically. While we’ve constantly kept a near connection that have come across borrowers within the Chicago, we’ve lengthened all of our procedures and they are happy to deploy a huge amount of funding to the investment functions in the Prepare County. The terminology ensure brief recovery times and are fitted to financing procedures ranging from purchase-and-hold, fix-and-flip, BRRRR Method, and more. Among the better hard money loan providers inside the Chicago, we work at buyers daily that are searching for flip/rehabilitation potential within the Chicago.

I recently closed for the latest you to definitely later Could possibly get of 2022 so when constantly, it was a pleasure to work with them. Scott and his awesome team are undoubtedly the very best in the business and always seems to answer questions inside a prompt manner. I recommend him or her for anyone hoping to get for the real property organization. I and financing all your renovations when you’re requiring attention-only costs during your loan label.

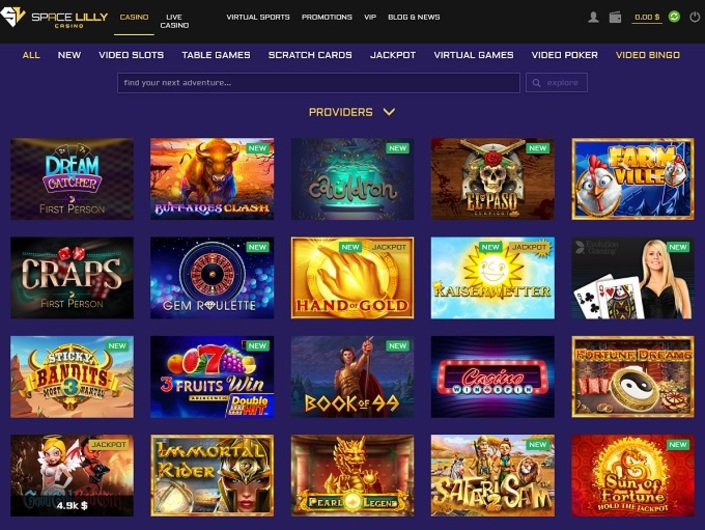

You could need to provide information about your credit history and finances. Once you’ve completed the program, opinion it carefully to make sure every piece of information try direct and you will done. Following, fill out the program and you can wait for the financial to review and techniques it. Immediately after going casino Wish Bingo review for a reputable tough money lenders Chicago, including HardMoneyMan.com LLC, the next step from the mortgage procedure would be to gather and prepare yourself the mandatory documents. As well, you may have to give files to your one existing liens otherwise mortgages on the property. It’s important to gather all of these files beforehand and you can have them prepared and ready to submit to the lender.

Considering a few recently submitted lawsuits, the brand new Bey’s is actually presumably running a good ‘home Ponzi scheme’ by luring newbie buyers to the joining predatory fund having Ramo Bey. Ramo & Michaele Bey would be the creators out of iFLIP Chicago, and you may combined, they say to possess twenty years of household flipping and you may actual house experience. The company promised a route to financial liberty and you can a go at the strengthening generational wide range. Chicago has many drawbacks such dense website visitors, severe winter months and you can Mitch Trubisky to play quarterback, nevertheless area have a deep cultural history and you can a strong, up-and-upcoming real estate market. Because of the dirty cost management procedure over the past a couple months away from 2024, and therefore provided Simple & Poor’s a week ago so you can downgrade the town’s borrowing from the bank, there’s reasoning in order to craving care inside taking on one the new personal debt. There are a handful of warning flag within this suggestion that have to be treated.

FBC Financing, LLC

- Awash with historical parks and you may a multitude out of nicknames, Chicago (and both called “The metropolis That works well”) is among the best four biggest Western cities at the time of 2023.

- CHICAGO (WLS) — Once 2 yrs from clear declines, the new Federal Organization from Realtors expects transformation from existing property usually improve within the 2024.

- Dan Nelson, an investor-amicable agent inside Chicago, states he enjoys “buy-and-hold leasing features for this urban area.

- Stress had been simmering for weeks, but one thing attained an excellent boiling point whatsoever seven people in the newest CPS Board out of Education launched their resignations over a great few days ago.

Professional participants rating endless entry to professional industry research, assets investigation calculators, private events, and a lot more. For as to why citizens are making, based on many reports, it’s because of large can cost you and you will a lack of work that fit its knowledge. It has to additionally be detailed you to definitely Chicago has achieved a track record in order to have rampant offense and you will group physical violence, which will not make they an appealing place to go for the brand new citizens. Which is often invited development to people who were reluctant to find an alternative household from the higher price of borrowing from the bank money. The application of individual money makes you size easily and you may leverage your own money. The brand new Redfin Vie Get cost how aggressive an area is found on a level of 0 in order to one hundred, in which 100 is one of competitive.

CBRE Acquires Industrious inside 800M Offer, Releases The fresh Office

Normally, property inside the Chicago sell just after 59 days in the industry opposed to help you thirty-six weeks a year ago. There had been step three,222 house available in February this season, right up away from 3,216 just last year. Chicago characteristics are in at around 260 dollars a square foot; that it really worth increased roughly nine per cent 12 months over seasons. You’ve got a thorough knowledge of the benefits and you may ins and outs out of earnest cash in the brand new Chicago a house landscaping.

As well as, you can utilize various other procedures and hacks to pay off the loan shorter. When you yourself have more cash circulate otherwise money to get on the your mortgage, the main due shrinks much faster. After you buy a house or take aside a bank loan, you must pay it back. But alternatively away from spending that from your own savings account, you have to pay along the financing that have book currency. A normal 30-season financing creates the main to your month-to-month mortgage payment.

The customer constantly should be present from the closing to help you signal the newest closing records. The main work of your own consumer at the closure would be to indication loan and you will home loan files, label company documents, and also the ALTA settlement declaration. People client that will end up being a borrower or co-borrower on the loan should be from the closure inside person to signal documents. Concurrently, one mate otherwise partner in the a municipal connection have what exactly are called homestead rights in almost any a home meant to be an initial residence.

The new lawsuits offer a prospective purpose for all of the, accusing Bey of conspiring to your lender, Believe Money, to profit off of the pricy loan extension fees of many investors paid off to quit defaulting on their fund. To your clock ticking on their quick-name, higher desire money, the fresh buyers informed NBC 5 Reacts they’d zero alternatives but in order to drop within their very own finance to expend iFLIP’s builders to start remodeling the flips. “We hit out to the fresh investment organization and you can questioned them exactly what is actually going on plus they told me my financing are mix collateralized and I am including, ‘Okay, what exactly is you to definitely? The new fund resemble commercial mortgage loans, meaning he is highest desire and you will short-term.

With a flourishing cost savings, historic focus, and you will rich social appeal, there’s a great deal to love about it novel heartland of American history. Home values are nevertheless reasonable from the Chicago city, and number lowest mortgage rates features brought about consumers to head to unlock selling. Despite the current escalation in consult, vendors come across property pick cost underneath the asking listing rate. Of several benefits investment a small decline in homes prices through the rest of 2020. Zillow was even a lot more pessimistic regarding the Chicago housing market, anticipating an excellent dos.3percent decrease in median home prices along the next 12 months. On the step 1.3percent from Chicago property owners is underwater on the home loan, that’s a good tick more than the newest national mediocre of just one.1percent.